Modern payment ecosystems increasingly demand solutions that balance operational efficiency with customer accessibility. Cash-to-card kiosks (also known as reverse ATMs) have emerged as strategic infrastructure that enables businesses to transition to cashless environments while continuing to serve customers who prefer or rely on cash. This guide examines the technical, operational, and strategic considerations business owners should evaluate to ensure successful implementation.

What Is Cash-to-Card Technology?

Core Architecture

Core Architecture

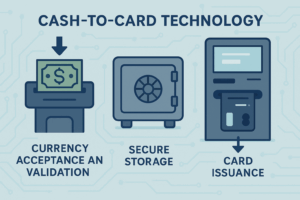

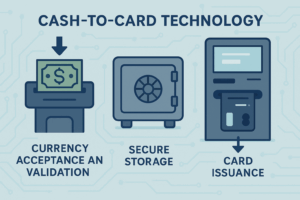

At their foundation, cash-to-card kiosks integrate hardware and software designed to convert physical currency into digital payment credentials. The technology typically involves three components working in sequence.

- Currency acceptance and validation: High-accuracy bill acceptors authenticate currency using optical scanning, magnetic sensing, and counterfeit detection.

- Secure storage: Validated funds are stored in tamper-resistant compartments with audit trails for reconciliation.

- Card issuance: Prepaid cards—often venue-branded—are encoded with equivalent value and activated instantly.

Touchscreen interfaces, intuitive prompts, and real-time confirmations guide customers through the process with minimal friction.

Software and Payment Integration

The software layer governs transaction speed, compliance, and reliability.

- Manage account creation, card activation, and balance tracking

- Enable real-time fund availability at POS terminals

- Detect fraud through transaction monitoring

- Integrate with payment processors and POS systems

Embedded analytics platforms provide visibility into usage patterns, transaction volumes, and system health—supporting both operations and long-term planning.

Deployment Planning and Site Assessment

Location Strategy

Placement strongly influences adoption. High-traffic, visible areas near entrances, ticketing, or concessions maximize usage. Kiosks should reduce bottlenecks while remaining accessible for monitoring and service. See our guides on cash-to-card use cases and stadium deployments.

Infrastructure Requirements

Kiosks require reliable power, network connectivity, and sufficient physical space. Compliance with ADA accessibility standards ensures all customers can complete transactions independently.

Security Considerations

Clear sightlines, adequate lighting, and surveillance integration strengthen deployment security. Placement must balance customer convenience with protection against misuse or tampering.

Optimizing Transaction Flow and User Experience

A seamless customer journey is essential. Clear language, visual prompts, and multi-language support reduce confusion and shorten transaction times. Customers should receive immediate confirmation when the card is dispensed and ready for use.

Security and Fraud Prevention

Security and Fraud Prevention

- Encrypted transaction processing

- PCI DSS compliance for cardholder data

- Fraud detection systems monitoring anomalies

- Advanced bill validation rejecting counterfeit or damaged notes

These layers protect both the business and the customer while building trust in the system.

Operational Management and Maintenance

- Cash collection: Balanced for security and efficiency

- Preventive maintenance: Reduces downtime and extends equipment life

- Inventory management: Tracks prepaid card stock

- Remote monitoring: Identifies issues before they impact customers

Consistent management preserves uptime, revenue, and customer confidence.

Financial Modeling and ROI

Cost advantages include reduced cash handling, lower theft risk, and labor savings. Revenue opportunities may include higher spend per customer and optional convenience fees. Break-even analysis should factor transaction volume, average load size, installation costs, and service fees.

Marketing and Customer Engagement

Marketing and Customer Engagement

- Branded prepaid cards for loyalty and visibility

- On-screen promotions during transactions

- Receipt-based offers for events and rewards

Vendor Evaluation and Selection

- Proven industry experience

- Compliance certifications (ISO 9001, PCI DSS)

- Reliable support and service-level agreements

- Transparent pricing and total cost of ownership

Conclusion

Cash-to-card kiosks are now a standard bridge between cash-dependent customers and cashless environments. When implemented thoughtfully, they deliver operational efficiency, risk reduction, and improved customer experience—while positioning organizations for future-ready payment ecosystems.

Core Architecture

Core Architecture Security and Fraud Prevention

Security and Fraud Prevention Marketing and Customer Engagement

Marketing and Customer Engagement