The transition from cash-based to digital payment environments presents both opportunities and challenges for venue operators across diverse industries. Custom prepaid card programs offer sophisticated solutions that maintain operational efficiency while serving customers who prefer or require alternatives to traditional payment methods.

The transition from cash-based to digital payment environments presents both opportunities and challenges for venue operators across diverse industries. Custom prepaid card programs offer sophisticated solutions that maintain operational efficiency while serving customers who prefer or require alternatives to traditional payment methods.

This guide examines the business case, implementation framework, and optimization strategies for prepaid card programs that deliver measurable value to both operators and customers.

The Strategic Business Case for Prepaid Programs

Prepaid card programs provide value that extends well beyond simple payment processing. They support operational efficiency, improve customer experience, and generate strategic business intelligence that can reshape decision-making. The most immediate benefit comes from operational cost reduction. Traditional cash handling requires staff for counting, reconciliation, deposits, and change management, all of which introduce human error and security risks. Prepaid systems eliminate much of this overhead while also reducing theft and shrinkage.

They also improve transaction speed. Cash exchanges slow lines during peak periods, while prepaid transactions process in seconds. Faster throughput increases venue capacity without requiring additional staff. For operators, this translates directly into revenue growth and improved customer satisfaction due to shorter wait times.

Finally, prepaid programs unlock data analytics. Unlike cash, every prepaid transaction is traceable, generating insights into customer preferences, spending behavior, and visit frequency. This intelligence supports better inventory planning, pricing strategies, and targeted marketing campaigns. Operators gain efficiency, revenue potential, and actionable customer insights while delivering a smoother, more modern payment experience.

Program Architecture and Design Considerations

Design decisions made at the outset of a prepaid program determine its long-term success. These include architecture type, account structure, card technology, and system integration.

One of the first choices is between closed-loop and open-loop architectures. Closed-loop programs limit usage to specific venues or networks, giving operators full control and simplified compliance. Open-loop programs, typically tied to major card networks, allow wider acceptance but bring more regulatory obligations and complexity. The choice depends on whether the goal is maximum control or maximum flexibility.

Account structures vary as well. Single-use disposable cards require minimal infrastructure but limit customer engagement. Reloadable cards encourage repeat use, building ongoing relationships and reducing per-transaction costs. Hybrid approaches offer flexibility to serve both one-time visitors and loyal customers.

Card technology influences functionality and security. Magnetic stripe cards are inexpensive and broadly compatible but less secure. Chip-based cards add fraud protection and enable contactless features. Dual-interface cards combine both for maximum flexibility and future-proofing.

Finally, integration architecture determines whether the system runs standalone or connects with existing platforms such as POS, inventory management, or CRM systems. Standalone models are simpler to launch, while integrated systems unlock greater efficiency and richer data insights. Careful architectural choices align program capabilities with venue strategy, balancing ease of deployment with long-term growth potential.

Card Design and Branding Strategy

Physical card design is more than a technical detail — it is a brand extension that customers carry in their wallets. Colors, typography, and graphics should reinforce brand identity while remaining legible and durable through everyday use. Functional elements like magnetic stripes, EMV chips, and printed numbers must comply with payment standards. Security elements such as holograms, microprinting, or color-shifting inks not only deter fraud but also communicate trustworthiness.

Many venues also create collectible or limited-edition cards tied to events, holidays, or special promotions. These designs increase engagement by appealing to customer pride and loyalty, encouraging repeat visits and ongoing retention of the card as a keepsake. Well-designed prepaid cards double as portable marketing assets that strengthen brand presence far beyond the venue.

Technology Infrastructure and System Integration

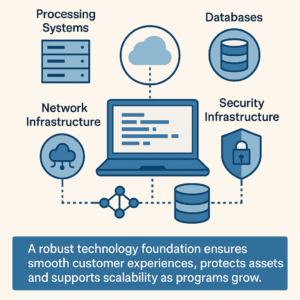

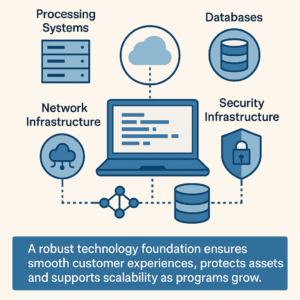

Reliable infrastructure underpins every prepaid program. At the core, processing systems handle account creation, balance tracking, and transaction authorization. High availability is essential, requiring redundant components and peak-capacity planning to avoid service interruptions. Databases store account and transaction information and must be protected through strong backup protocols, geographic redundancy, and encryption. Optimized query performance supports fast customer interactions. Network infrastructure links terminals, kiosks, and administrative systems. Redundant connections and offline-capable designs prevent outages from disrupting service, while synchronization ensures balances remain accurate across systems.

Reliable infrastructure underpins every prepaid program. At the core, processing systems handle account creation, balance tracking, and transaction authorization. High availability is essential, requiring redundant components and peak-capacity planning to avoid service interruptions. Databases store account and transaction information and must be protected through strong backup protocols, geographic redundancy, and encryption. Optimized query performance supports fast customer interactions. Network infrastructure links terminals, kiosks, and administrative systems. Redundant connections and offline-capable designs prevent outages from disrupting service, while synchronization ensures balances remain accurate across systems.

Finally, security infrastructure is paramount. Encryption, access controls, intrusion detection, and layered monitoring safeguard both financial and personal data. A robust technology foundation ensures smooth customer experiences, protects assets, and supports scalability as programs grow.

Customer Acquisition and Program Launch

A strong launch strategy is critical for adoption. Preparation begins with staff training so employees can explain benefits, help with enrollment, and troubleshoot issues. Sports arenas and stadiums have successfully deployed these systems to streamline payment processes and enhance customer experience. Marketing should use multiple channels — digital, in-venue signage, and direct staff engagement — to raise awareness. Promotions such as bonus value on first loads or discounts for early adopters reduce barriers and build momentum.

Many operators employ a soft launch, releasing the program to a limited audience before full rollout. This controlled approach allows time to identify system issues, refine communications, and incorporate feedback. Once stable, a high-visibility launch event can generate excitement and customer enthusiasm. A well-executed launch establishes confidence, drives adoption, and positions the program for long-term success.

Promotional Strategies and Customer Incentives

Prepaid card programs thrive on continuous engagement. Promotions can target acquisition, usage, reloads, or partnerships. Acquisition offers — such as bonus credits or limited-time discounts — reduce entry barriers. Usage promotions encourage higher spending or frequency, while reload incentives keep accounts active and increase transaction values. Partnership promotions with complementary businesses can expand reach and create co-branded experiences, deepening value for customers. Strategic incentives sustain engagement, increase card loads, and maximize lifetime customer value.

Operational Management and Customer Service

Operational excellence is the backbone of prepaid program success. Daily processes include secure balance management, dispute resolution, and card inventory tracking These versatile systems efficiently handle multiple operational processes across different venue types. Customer service must cover common needs: balance inquiries, lost card replacements, and transaction disputes. Offering multiple support channels — from in-person to self-service via apps — ensures accessibility. Clear dispute resolution policies protect both customers and operators. Strong operations and service build trust, reduce churn, and keep programs running smoothly.

Financial Management and Accounting

Prepaid programs carry unique accounting requirements. Funds received from customers must be tracked as prepaid liabilities until redeemed. Regular reconciliation ensures system balances match actual funds. Unused balances, known as breakage, can be recognized as revenue depending on regulations, but conservative policies help maintain compliance and trust.

Programs may also generate revenue from fees such as issuance, reloads, or inactivity — all of which must be transparent and legally compliant. Careful cash flow management ensures float balances remain sufficient for redemption while enabling operators to maximize investment opportunities. Proper financial management ensures regulatory compliance and protects both customer confidence and operator stability.

Data Analytics and Business Intelligence

Data Analytics and Business Intelligence

Prepaid transactions provide a wealth of data that cash cannot. Segmenting customers by spending habits, visit frequency, or reload behavior allows for tailored engagement strategies. Predictive analytics can forecast churn, enabling preemptive retention efforts, while lifetime value modeling helps justify acquisition investments. Purchase patterns guide inventory management and pricing decisions. A/B testing can be applied to promotions, communications, and program features, providing evidence-driven improvements. Analytics turn payment data into strategic intelligence that supports smarter business decisions and more personalized customer engagement.

Regulatory Compliance and Legal Considerations

Prepaid programs operate within a complex regulatory environment. Consumer protection rules require clear disclosure of fees, terms, and expiration policies. State-by-state escheatment laws govern unclaimed balances, requiring transfer to state authorities after dormancy periods. Open-loop programs must also comply with major payment network rules, including PCI DSS for security. Meanwhile, data privacy laws such as GDPR add requirements for transparency, customer consent, and rights management. Proactive compliance avoids legal penalties, protects brand reputation, and builds customer trust.

Mobile Integration and Digital Innovation

Mobile technology expands prepaid program capabilities. Dedicated apps allow customers to check balances, reload accounts, and view history anytime. Push notifications deliver promotions or low-balance alerts. Integration with digital wallets like Apple Pay or Google Pay extends usability to contactless payments, while QR codes offer quick, card-free transactions. Geolocation services enable proximity-based promotions or fraud detection. Digital integration improves convenience, engagement, and operational flexibility, making prepaid programs more attractive to modern consumers.

Program Evolution and Continuous Improvement

No prepaid program is static. Regular customer feedback, competitor analysis, and technology upgrades ensure ongoing relevance. Infrastructure refresh cycles and benchmarking against industry best practices help maintain performance. Continuous improvement protects competitiveness and ensures programs remain aligned with customer expectations.

Strategic Partnership Opportunities

Partnerships extend program reach and value. Co-branded cards deepen brand associations, while loyalty program integrations tie prepaid usage to rewards. Retail distribution partnerships expand accessibility, and technology partnerships reduce development costs while enhancing features. Strategic alliances enhance program appeal, expand reach, and create competitive differentiation.

Conclusion

Custom prepaid card programs deliver strategic value that far exceeds payment processing. They reduce costs, accelerate transactions, enhance customer experience, and provide valuable business intelligence. Organizations considering implementation often have questions about deployment, which should be addressed early in the planning process. By asking the right questions from the start of the project, designing thoughtful architecture, building robust infrastructure, engaging customers through promotions, and maintaining operational excellence, operators can create programs that deliver both immediate and long-term benefits.

Custom prepaid card programs deliver strategic value that far exceeds payment processing. They reduce costs, accelerate transactions, enhance customer experience, and provide valuable business intelligence. Organizations considering implementation often have questions about deployment, which should be addressed early in the planning process. By asking the right questions from the start of the project, designing thoughtful architecture, building robust infrastructure, engaging customers through promotions, and maintaining operational excellence, operators can create programs that deliver both immediate and long-term benefits.

As payment ecosystems evolve, prepaid programs offer flexible platforms that adapt to new technologies and customer expectations. They represent not just a payment method but a competitive advantage for venues seeking to thrive in a digital-first environment.

Custom Prepaid Card Programs FAQ

- What's the typical implementation timeline for a custom prepaid program?

Implementation typically takes 3-6 months depending on complexity, including system integration, compliance review, card design, staff training, and pilot testing phases.

- How do closed-loop and open-loop programs differ in regulatory requirements?

Closed-loop programs face fewer regulatory hurdles but offer limited acceptance. Open-loop programs require compliance with payment network rules, PCI DSS standards, and often money transmitter licenses.

- What percentage of loaded funds typically go unredeemed (breakage)?

Breakage rates vary by industry and program design, typically ranging from 5-20%. Sports venues and entertainment generally see higher redemption rates than retail or corporate programs.

- Can prepaid programs integrate with existing loyalty systems?

Yes, modern prepaid platforms support API integration with CRM and loyalty systems, enabling unified customer profiles and cross-program benefits.

The transition from cash-based to

The transition from cash-based to  Reliable infrastructure underpins every prepaid program. At the core,

Reliable infrastructure underpins every prepaid program. At the core,  Data Analytics and Business Intelligence

Data Analytics and Business Intelligence Custom prepaid card programs deliver strategic value that far exceeds payment processing. They reduce costs, accelerate transactions, enhance customer experience, and provide valuable business intelligence. Organizations considering implementation often have questions about deployment, which should be addressed early in the planning process.

Custom prepaid card programs deliver strategic value that far exceeds payment processing. They reduce costs, accelerate transactions, enhance customer experience, and provide valuable business intelligence. Organizations considering implementation often have questions about deployment, which should be addressed early in the planning process.