The landscape of payment processing has undergone dramatic transformation over the past decade. From the early days of magnetic stripe cards to today’s contactless systems, businesses have continuously adapted to meet changing consumer expectations while managing operational complexity.

Among the most significant developments in this evolution is the emergence of cash-to-card and reverse ATM technology, which bridges the gap between traditional cash transactions and modern digital payment systems.

Understanding the Modern Payment Ecosystem

Today’s payment environment is a hybrid of legacy and modern systems. Traditional point-of-sale platforms process credit and debit cards, while newer solutions incorporate mobile wallets, QR codes, and contactless transactions.

Despite this technological progress, cash remains relevant for millions of consumers. Federal Reserve data shows that cash transactions still account for a substantial portion of retail purchases, especially among certain demographics and regions. This creates friction for businesses pursuing fully cashless models: how to reap the benefits of digital transactions without excluding cash-preferring customers.

Business outcome: To stay inclusive while modernizing, operators need solutions that serve both digital-first and cash-reliant customers.

The Rise of Cashless Payment Solutions

Cashless payment models gained traction as businesses sought to reduce costs, mitigate theft, and speed up transactions. Early versions focused narrowly on card acceptance, but today’s ecosystems are far more sophisticated, capable of supporting multiple payment types securely and efficiently.

The benefits extend well beyond convenience. Cashless operations lower labor and security expenses associated with handling cash, reduce theft vulnerability, accelerate transaction times, and generate actionable data for analytics. These advantages explain their adoption across retail, hospitality, transportation, and entertainment.

Yet, fully eliminating cash carries risk. Customers who prefer or rely on cash may feel excluded, leading to lost revenue or reputational harm. Hybrid approaches emerged as the solution—keeping the efficiency of digital transactions while accommodating cash users through cash-to-card technology.

Cash-to-Card Technology: The Bridge Solution

Cash-to-card systems address the key challenge of going cashless: how to maintain operational efficiency while still serving customers who only carry cash. Rather than rejecting cash outright, these kiosks convert currency into prepaid digital value.

Customers deposit cash, receive a prepaid card or digital credit in equivalent value, and can immediately spend it throughout the venue. Conversion happens in seconds, keeping lines moving without the delay of having to make change for cash-using customers.

The resulting cards behave like debit cards within the venue’s ecosystem, offering customers a seamless experience while freeing businesses from the burden of cash handling.

Modern systems are built with multiple layers of protection—encrypted transaction processing, secure cash storage, real-time monitoring, and full audit trails—meeting or exceeding banking-grade expectations. Venues gain all the benefits of going cashless—speed, security, analytics—without excluding cash-based customers.

Technical Architecture and Implementation

Cash-to-card kiosks combine hardware and software into a unified system.

- Bill acceptors use advanced validation to authenticate currency and reject counterfeits.

- Secure storage modules safeguard deposited funds while maintaining accurate inventory.

- Card dispensers encode and deliver prepaid cards reliably, even under heavy use.

On the software side, transaction engines manage account creation, balance allocation, and POS integration. Real-time communication ensures immediate card activation across all venue terminals.

Connectivity enables remote monitoring and analytics dashboards that track transaction volumes, peak usage times, and system health—data that supports both day-to-day management and strategic planning. Robust architecture ensures reliability, protects revenue, and generates insights that cash handling cannot.

Integration with Existing Payment Infrastructure

Cash-to-card kiosks must function as part of the broader payment environment. Integration with point-of-sale systems ensures prepaid cards are accepted immediately across all terminals, with no difference in user experience.

This typically involves API connections between the kiosks and payment processors, supporting functions like account creation, balance inquiries, and settlement. Standardized protocols make systems compatible with a wide range of existing POS hardware and software.

Advanced implementations add value through branded card customization, loyalty program tie-ins, and promotional bonuses—turning the kiosks into marketing tools as well as payment infrastructure. Seamless integration reduces friction, strengthens customer experience, and creates opportunities for brand engagement.

Operational Benefits and Business Impact

The operational improvements are immediate and measurable. By automating cash acceptance, venues reduce labor costs, shrink theft risk, and eliminate time spent reconciling tills and transporting deposits.

Transaction speeds increase because digital payments process faster than cash exchanges. This boosts throughput during peak periods, enabling more sales without adding staff. Customers benefit from shorter lines and smoother experiences.

Data capture is another advantage. Cash-to-card transactions generate detailed insights into spending behavior, supporting smarter inventory, staffing, and marketing decisions. Over time, operators also see reduced banking fees, more accurate reporting, and stronger financial controls.

Venues achieve cost savings, faster service, better customer satisfaction, and improved decision-making.

Security and Compliance Considerations

Because they handle both cash and digital value, cash-to-card systems must meet stringent security standards. Encryption protects transaction data in transit and at rest. PCI DSS compliance ensures cardholder information is handled properly.

Tamper-evident housings, secure mounts, and surveillance integration protect physical hardware. Regulatory requirements vary by jurisdiction but often include money transmission licensing, consumer protection laws, and financial reporting obligations. Many systems now embed compliance tools to simplify operator responsibilities.

Strong security and compliance frameworks protect both customer trust and operator liability.

Customer Experience and Adoption

Technology only succeeds if customers use it. Cash-to-card adoption hinges on intuitive design and strong education. Interfaces must be simple, with clear instructions, progress indicators, and multi-language options.

Customers should be able to complete conversions quickly, with immediate activation confirming success. Education is equally important. Staff training, in-venue signage, and promotional campaigns help first-time users understand the process. Venues that actively promote and assist see significantly higher adoption.

Simple, fast, and well-communicated systems build customer trust and drive repeat use.

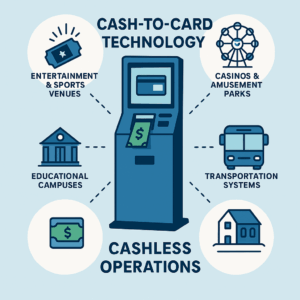

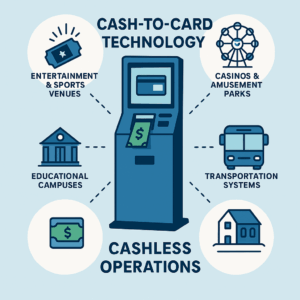

Industry Applications and Use Cases

Cash-to-card technology is proving valuable across industries and use cases:

- Entertainment and sports venues accelerate concession sales while reducing theft risk.

- Casinos and amusement parks support customers who prefer cash while streamlining internal operations.

- Transportation systems modernize fare collection for riders without cards.

- Educational campuses enable students and visitors to use prepaid cards for dining and services.

- Festivals and pop-up events rely on portable systems to stay cashless in temporary settings.

Each environment configures the system differently, but the principle is the same: maintain the advantages of cashless operations without excluding cash-using customers.

Future Developments and Market Trends

The reverse ATM and cashless payment market is advancing quickly. Mobile integration now allows customers to manage balances and reload cards via smartphone apps. Loyalty programs tie spending to rewards, encouraging ongoing usage.

Artificial intelligence is being deployed for fraud detection, predictive maintenance, and usage forecasting. Cloud-based platforms are reducing the need for on-site infrastructure while improving scalability. Sustainability goals are shaping energy-efficient kiosk designs and reduced material use.

Continuous innovation ensures cash-to-card systems remain relevant, adaptable, and aligned with evolving customer expectations.

Selecting the Right Cash-to-Card Solution

Operators evaluating solutions should weigh several factors:

- Transaction volume capacity relative to peak demand.

- Integration compatibility with current POS and payment processors.

- Security and compliance support for jurisdictional requirements.

- Long-term service, maintenance, and vendor support.

- Transparent cost models that account for both upfront investment and ongoing fees.

Careful vendor evaluation protects ROI and ensures system longevity. Asking the right questions can mean the difference between a successful deployment and an expensive, time-consuming mistake.

Implementation Best Practices

Successful rollouts depend on planning. Site assessments identify optimal kiosk placement for visibility and flow. Staff training ensures smooth customer support. Marketing campaigns prepare customers for the change.

Phased rollouts allow time for optimization and customer feedback. Regular maintenance schedules preserve reliability, while continuous monitoring ensures systems stay aligned with customer needs.

A methodical, customer-focused implementation maximizes adoption and minimizes disruption.

Conclusion

Cash-to-card technology represents the practical bridge between cash and digital transactions. By converting physical currency into usable digital value, these systems allow businesses to enjoy the efficiencies of cashless operations without excluding cash-reliant customers.

The technology delivers measurable benefits: reduced costs, faster service, improved customer satisfaction, and richer analytics. With innovations in mobile, AI, and cloud infrastructure, cash-to-card is positioned to expand its role in the evolving payment landscape.

For operators, adopting cash-to-card today is not just about keeping up with technology—it’s about creating inclusive, efficient, and future-ready payment ecosystems.

Cashless Payment Solution FAQ

How quickly can customers convert cash to a prepaid card?

Most modern cash-to-card kiosks complete transactions in about 30 seconds. Customers insert cash, receive their prepaid card, and can use it immediately at any point-of-sale terminal in the venue.

What percentage of cash customers actually use these kiosks?

Adoption rates typically range from 15–30% in the first few months, increasing over time as customers become familiar with the process. Proper placement and staff education significantly impact these numbers.

Can venues customize the prepaid cards with their own branding?

Yes, most systems offer full card customization including logos, colors, and messaging. Custom branded cards can also serve as marketing tools that customers may keep as souvenirs.

What happens if the kiosk runs out of prepaid cards?

Systems include remote monitoring that alerts operators before supplies run low. Many venues maintain backup card inventory and establish restocking schedules based on usage patterns.

Do cash-to-card systems work if internet connectivity is interrupted?

Basic kiosk functions can operate offline for short periods, but card activation and POS integration typically require network connectivity. Many systems include backup communication methods to minimize disruption.

Are there fees for converting cash to prepaid cards?

Fee structures vary by venue and local regulations. Some operators absorb costs as part of their cashless strategy, while others may charge small convenience fees. Transparent fee disclosure is standard practice.