If you operate cashless kiosks, smart vending, or automated retail in New York, you’re now inside the final window to implement a compliant solution under Senate Bill S4153A. Starting in March 2026, most in-person retail businesses in New York will be required to accept cash — and that includes self-service and automated environments.

For operators who’ve spent years building cashless infrastructure, this feels like a step backward. The good news? You don’t have to rip out card readers or reintroduce cash handling at every endpoint. There’s a compliant workaround, and it’s called a reverse ATM (cash-to-card kiosk).

Here’s what the law requires, why it matters for automated retail, and how to stay compliant without blowing up your operations — even with enforcement just weeks away.

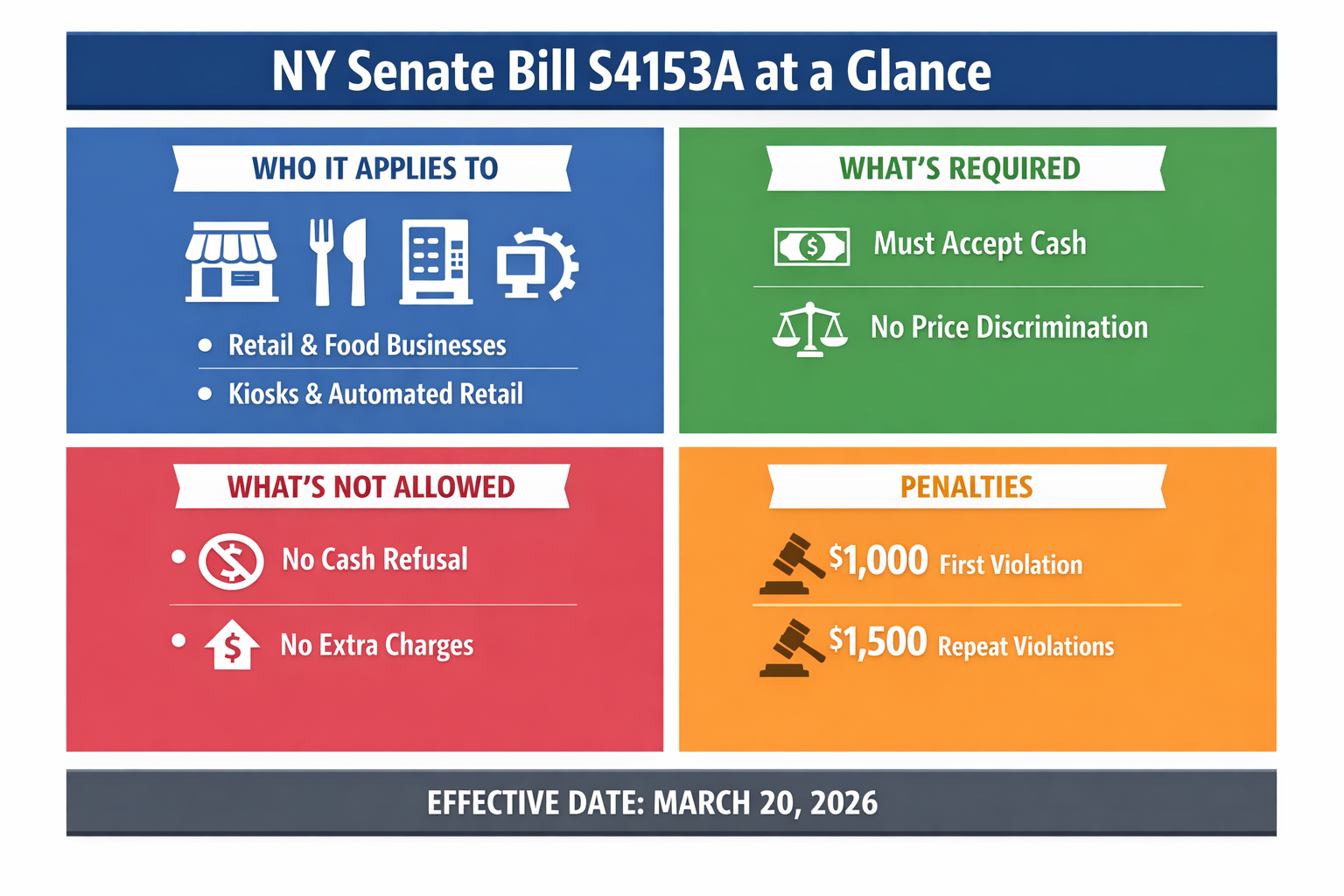

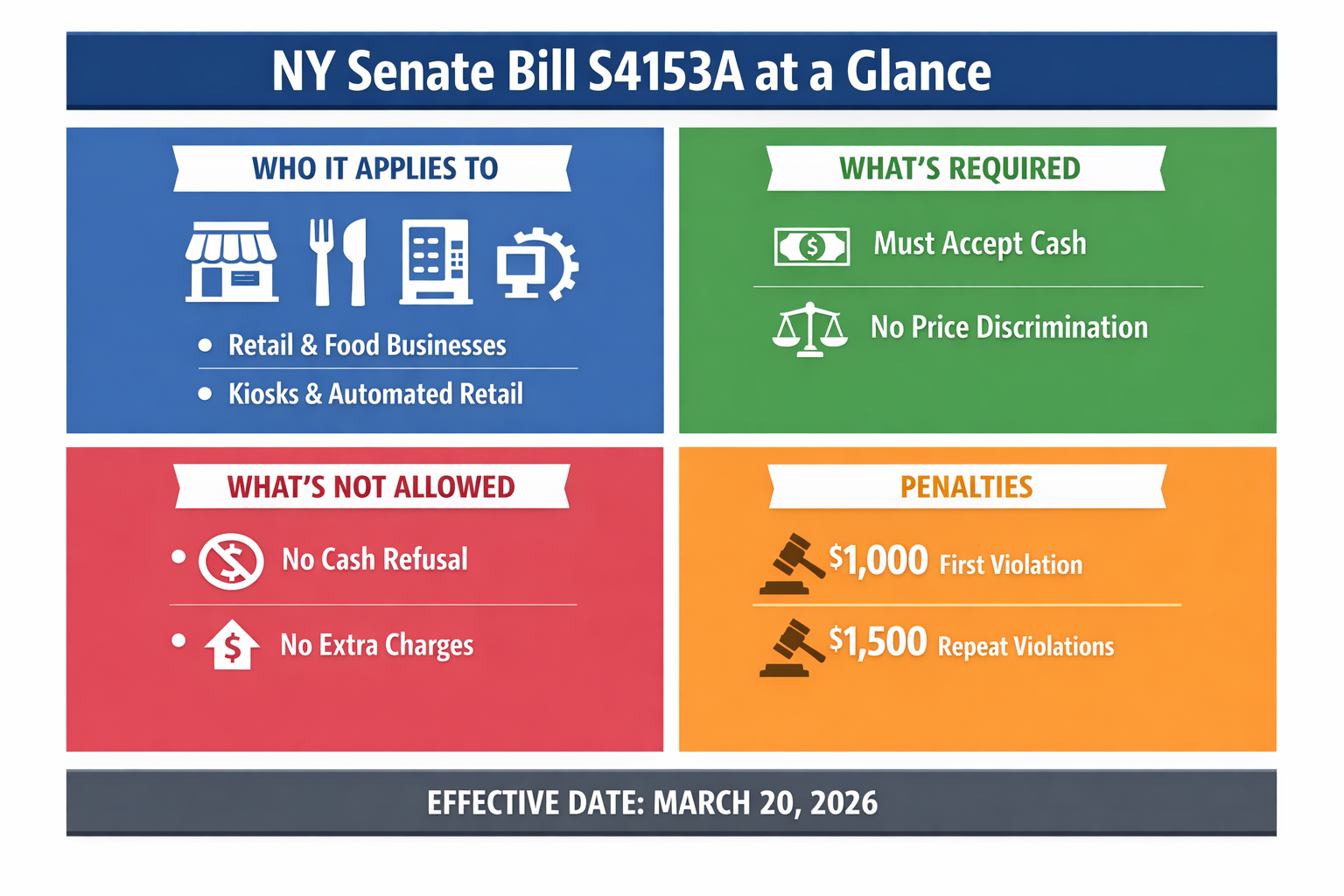

What Does Senate Bill S4153A Actually Require?

Senate Bill S4153A amends New York’s General Business Law to prohibit retail establishments from refusing cash for in-person transactions. The intent is to protect consumers who rely on cash — including unbanked and underbanked populations — and ensure equitable access to goods and services.

Key requirements:

- Businesses must accept U.S. currency for in-person purchases under $20

- You cannot charge higher prices for cash transactions

- Violations carry civil penalties of up to $1,000 for a first offense and $1,500 for repeat violations

- The law applies broadly to retail and food service, including automated and self-service environments

Enforcement begins around March 20, 2026, roughly 120 days after the bill was signed.

Once enforcement begins, compliance is binary — either customers can pay with cash in a compliant way, or they can’t.

If you’re running smart vending machines, self-service kiosks, or any cashless retail setup, you are in scope.

The Critical Exception: Cash-to-Card Conversion Devices

This is the provision that matters most for automated retail operators.

S4153A includes a narrow but critical exception allowing businesses to use an on-site device that converts cash into a prepaid card, as long as the device meets specific consumer protections.

To qualify, the cash-to-card device must:

- Charge no fees

- Allow deposits as low as $1

- Provide a printed receipt

- Issue funds that do not expire

The device must also be accessible during normal business hours, which means uptime and reliability are part of compliance — not just convenience.

This exception exists specifically for environments where traditional cash handling isn’t practical. It’s how cashless stadiums, hospitals, universities, and automated retail operators can remain compliant without reverting to legacy cash operations. Learn more about how reverse ATMs work.

Why Cashless and Automated Businesses Are Most at Risk

Many modern retail environments were intentionally designed to eliminate cash:

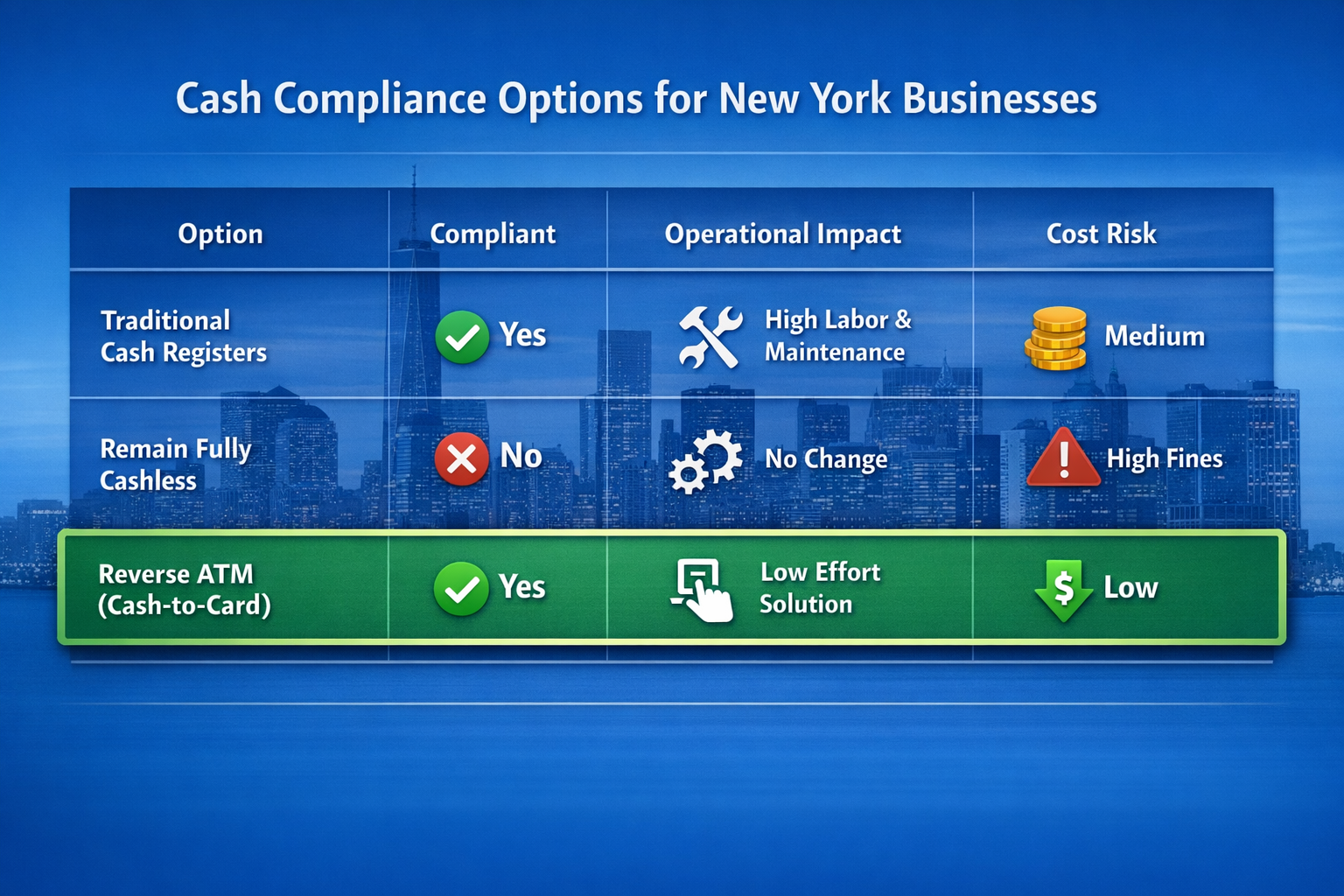

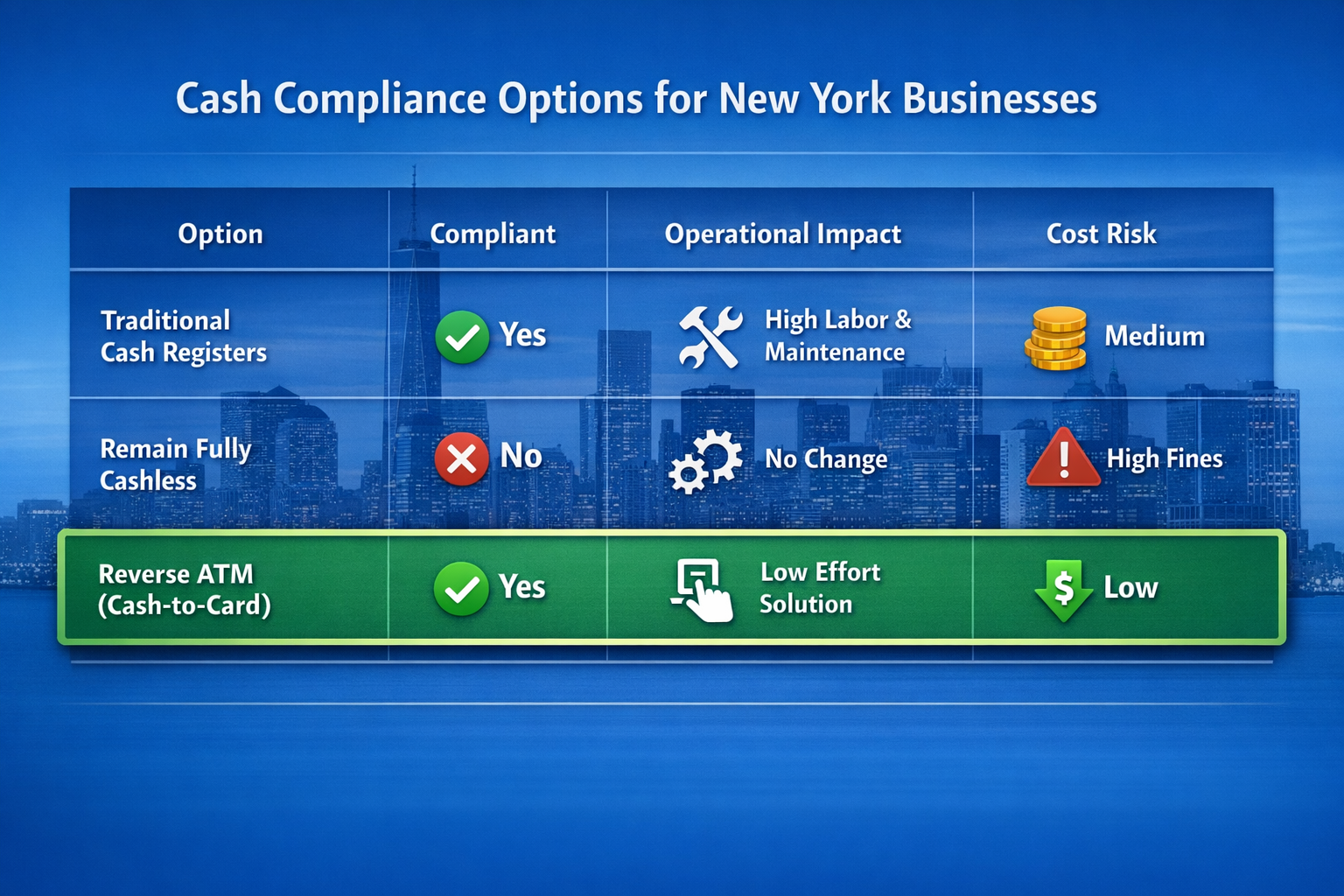

For these operators, adding traditional cash acceptance isn’t just inconvenient — it’s often impractical or cost-prohibitive. Retrofitting payment kiosks to handle cash introduces:

- Increased hardware costs and ongoing maintenance

- Cash handling labor and security concerns

- Frequent service calls for bill jams and acceptor issues

- Slower transactions and longer lines

Without a compliant alternative, businesses face fines, forced equipment changes, and disrupted customer experiences.

Simply put, doing nothing isn’t an option.

How Reverse ATMs Solve the Compliance Problem

A reverse ATM, also known as a cash-to-card kiosk, converts physical cash into a prepaid card that can be used immediately in cashless and automated retail environments.

When properly deployed, reverse ATMs allow operators to:

- Meet S4153A’s cash acceptance requirements without handling cash at every endpoint

- Preserve the cashless infrastructure already in place

- Reduce cash handling risks, labor costs, and maintenance headaches

- Improve accessibility for customers who rely on or prefer cash

- Maintain clean, electronic transaction records across operations

Rather than stepping backward operationally, reverse ATMs allow businesses to move forward — compliantly.

What Makes a Compliant Cash-to-Card Solution

Not all reverse ATMs are created equal. To meet S4153A requirements, your deployment must meet both legal and operational standards.

Legal Requirements (Non-Negotiable)

- Fee-free operation: No charges to convert cash

- Low minimum deposit: Must accept deposits as low as $1

- Receipt generation: Printed confirmation required

- Non-expiring funds: Card value cannot expire

- Accessibility: Must be available during normal business hours

Operational Reality (Where Most Solutions Fall Short)

Beyond the legal checklist, real-world performance matters:

- User experience: Can customers easily understand and use the device?

- Uptime and reliability: What happens if a bill acceptor jams or a printer runs out?

- Serviceability: How quickly can issues be resolved in unattended environments?

- Scalability: Can the solution be deployed across multiple locations quickly?

This is where working with an experienced kiosk manufacturer makes a difference. Learn more in our 8 common questions about cash-to-card kiosks.

Fast Deployment Matters — and It’s Still Possible

With enforcement less than two months away, remaining timelines are tight — but compliance is still achievable for operators that act quickly and choose the right solution.

Unlike fully custom kiosk builds, REDYREF’s cash-to-card solutions are production-ready and designed for rapid deployment.

Typical deployment timeline for an off-the-shelf cash-to-card kiosk:

- Solution selection & configuration: 1–2 weeks

- Branding (custom vinyl wraps): Runs in parallel

- Manufacturing & staging: 1–2 weeks

- Delivery & placement: Days, not months

- Activation & staff orientation: Minimal

For many operators, this means a compliant solution can be ordered, delivered, and live within a few weeks — if action is taken now.

At this stage, compliance is no longer about strategy. It’s about execution.

How REDYREF Helps Operators Stay Compliant

REDYREF has been designing and manufacturing self-service kiosks and automated retail solutions for over 20 years, supporting operators in regulated, high-traffic, and multi-location environments where compliance isn’t optional.

REDYREF’s cash-to-card kiosk solutions are built for:

- State and municipal regulatory compliance

- High-traffic unattended environments

- Long-term reliability and serviceability

- Rapid deployment without custom engineering delays

- Scalable rollouts across multiple sites

REDYREF works directly with operators to ensure deployments aren’t just functional — they’re defensible from a compliance standpoint, today and as similar legislation expands to other states. Explore the versatility of cash-to-card kiosks and discover 8 uses for reverse ATMs.

Frequently Asked Questions About New York’s Cash Acceptance Law (S4153A)

Do cashless kiosks and automated retail need to accept cash in New York?

Yes. Under Senate Bill S4153A, most in-person retail environments — including self-service kiosks, smart vending, and automated retail — must provide customers with a way to pay using cash.

Are reverse ATMs (cash-to-card kiosks) allowed under S4153A?

Yes. S4153A includes a specific exception that allows on-site cash-to-card conversion devices, as long as they charge no fees, allow deposits as low as $1, provide receipts, and issue funds that do not expire.

Do businesses have to handle cash directly to comply with the law?

No. Businesses do not need to accept cash at every point of sale if they provide a compliant on-site cash-to-card solution that allows customers to convert cash into a usable payment method.

When does New York Senate Bill S4153A take effect?

Enforcement is expected to begin around March 20, 2026, approximately 120 days after the bill was signed into law.

Is it too late to deploy a compliant solution before enforcement begins?

No. Off-the-shelf cash-to-card kiosks can often be delivered and deployed within weeks, making compliance achievable for operators who act quickly.

Get Ahead of New York’s Cash Acceptance Law

New York Senate Bill S4153A enforcement begins in March 2026. REDYREF helps businesses deploy compliant, fee-free cash-to-card kiosks that meet legal requirements without disrupting operations or abandoning cashless infrastructure.

Contact REDYREF today to evaluate your current payment setup and deploy a compliant, off-the-shelf cash-to-card solution within weeks — not months — with confidence before enforcement begins.